All Tax Forms - Georgia Department of Revenue

State of GA Department of Revenue forms related to taxes.

Series 100 Georgia tax credits (except Schedule 2B refundable tax credits) are claimed on Form 500 Schedule 2 and returns that include the series 100 credits must be filed electronically.

Georgia State Tax Forms

Tax-Rates.org provides free access to printable PDF versions of the most popular Georgia tax forms. Be sure to verify that the form you are downloading is for the correct year.

Georgia Income Tax Forms By Tax Year. e-File Your Taxes.

May 22, 2025 · Use the links below or search for the specific form you need. Important Note: You may also need to file previous year IRS tax forms in addition to your Georgia return.

Forms - Georgia Department of Revenue

This form is for a net operating loss carry-back adjustment by an individual or fiduciary that desires a refund of taxes afforded by carry-back of a net operating loss.

Printable Georgia Income Tax Forms for Tax Year 2024

Print or download 31 Georgia Income Tax Forms for FREE from the Georgia Department of Revenue.

Georgia Department of Revenue

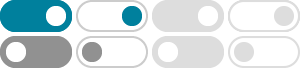

Print Blank Form>

Print Blank Tax Forms - Georgia Department of Revenue

Complete, save and print many of our forms online using a browser. The forms linked below cannot be completed online or by using Adobe Acrobat. They can only be printed and …

Georgia Form IT-511 (Individual Income Tax Booklet)

Download or print the 2024 Georgia Form IT-511 (Individual Income Tax Booklet) for FREE from the Georgia Department of Revenue.

500 Individual Income Tax Return - Georgia Department of Revenue

Complete, save and print the form online using your browser.